As more people choose to rent rather than buy – driven by affordability, flexibility, and changing lifestyle preferences – traditional homeownership models are evolving.

Expat Kiwi Andrea Salter has been at the forefront of the build-to-rent (BTR) market in the UK for over a decade. In this article, she shares her insights into a property investment model that’s reshaping how people live – and how investors think.

Why More People Are Choosing to Rent.

The idea of spending the weekend mowing the lawns or up a ladder cleaning the gutters of your newly purchased house may not be top of the list of preferred activities for everyone. Most commentators would agree that home ownership is a good long-term investment, but it does involve time, money and commitment.

Expatriate Kiwi Andrea Salter has been living in the UK for the past 20 years, working most recently as a director at Apo, a company that specialises in build-to-rent projects, and she has noticed changes in the thoughts and patterns of people regarding attitudes to home ownership.

“Young people used to start saving for a house in their 20s and 30s, but more people now seriously consider long-term rentals. It’s much harder to save a deposit, and then there are the ongoing maintenance costs once you buy your house,” she says. “Renting is becoming more attractive, with more people in the UK, Europe and the US choosing to live in apartments. The convenience of living in a rental property means you don’t need to handle maintenance, or fix things when they break, so there’s less stress and hassle.”

“There’s also the commitment that goes with home ownership. And with different working situations today, we have more digital nomads, as well as people who move regularly for their work, who don’t want to be disadvantaged because they own a house.” In the UK, buyers must also pay stamp duty of up to 12 percent of the home’s value to the government. Build-to-Rent offers more flexibility.

What Is Build-to-Rent?

In the UK, build-to-rent companies – funded by institutional investors such as pension funds – construct large-scale, multi-unit residential buildings specifically for renters. The funders retain full ownership and rent the apartments—often on longer leases—instead of selling them to individual owners or smaller investors. Professional management companies operate the developments and include a range of extra features that appeal to renters.

“In the UK, these big investors provide the development funding up front, then hold on to the asset long-term or at least until it stabilises—meaning it reaches about 95 percent occupancy, runs smoothly, and delivers a stable income return.” These investors appreciate the BTR model because it generates more predictable income and avoids the significant highs and lows often seen in traditional build-to-sell property developments,” says Andrea.

Features That Set Build-to-Rent Apart.

Apartment complexes generally have concierge services to welcome tenants and visitors and to collect parcels. On-site handymen assist tenants with smaller jobs like hanging pictures. Complexes are often pet-friendly and offer a range of facilities such as co-working spaces, lounges, TV rooms, gyms, podcast spaces, and cafés, restaurants and metro supermarkets at ground level. Many include free fibre broadband as part of the rental package.

Tenants have access to roof terraces designed with a range of zones, including outdoor entertainment spaces with barbecues and outdoor eating areas, relaxation zones for chilling out and yoga classes, and even games and exercise areas.

And, of course, location is important; in UK cities, apartments must be located near public transport and in areas where tenants genuinely want to live.

From Northland to the UK Property Scene.

Originally from Whangarei, Andrea won a scholarship from the Auckland-based Keystone Trust, which offers scholarships to students pursuing careers in the property sector. Keystone supported her through five years at the University of Auckland’s School of Architecture. After graduating, she joined Bovis Lendlease as a site engineer working on a new care centre and apartments at St Andrew’s Retirement Village in Auckland. The role was broad and included design, finance, project management, client interface, and subcontract management.

When the travel bug bit, Andrea headed off to Europe and joined one of the UK’s oldest construction companies, Willmott Dixon. She worked her way up through the quantity surveying ranks into the senior management team, completed a secondment into the repairs and management division, and later transitioned to the BTR arm of the business.

“I would never have taken this path without the support of the Trust. Apart from the financial assistance, they provided mentorship and a great network of support, assistance and contacts in the property industry.”

“In fact, I received my first job offer at the graduation dinner after I finished my degree. And, while I have never practiced as an architect, the skills I learned inform every aspect of my work,” she says.

Building Better: Design and Durability Matter.

For these developments to succeed, Andrea says, developers must invest a huge amount of care and planning into even the smallest details. These are complex projects and often require five or more years from inception to completion, says Andrea. Her role covers land acquisition, design, planning, construction, finance, and handover of the finished product to the operational management team. “Our experience in the UK is that larger schemes of, for example, 400+ units, gain from economies of scale. Smaller schemes – say, 150 apartments – are less cost-effective, unless you have several in the same area to spread the running costs across.”

“We focus on what end users are going to want; we must design buildings and spaces that people are going to find attractive, enjoy and want to stay in long term.”

Every apartment complex includes a mix of studio, one, two and three-bedroom flats, to suit a range of tenants, from single professionals, to flat mates, couples and older retirees downsizing from a bigger family home. “Apartments are generous in their dimensions, and we aim to make them as user-friendly as possible. For example, our two-bedroom apartments feature bedrooms and bathrooms of equal size, so friends can flat together comfortably.

“We focus on ensuring the interiors are well-built with durable, quality products that are easy to maintain and repair, and don’t have to be replaced frequently, and when items such as cabinetry do need replacement, it is straightforward.

We also design shared spaces to be flexible, and we learn from each completed scheme what facilities residents use, want and value. For example, there’s no point in building a huge gym and spending resources maintaining it if hardly anyone uses it.”

Andrea says that while standardised designs are the optimum, different councils impose different planning regulations, affecting outdoor area requirements, apartment size, window placement, and many other details, along with the shape of the land, all of which impact the overall design.

“So the challenge for the developer, designer, and builder is to strike a balance between government regulations, investor needs, and creating a product that tenants will find attractive.”

Creating Communities with Technology and Support.

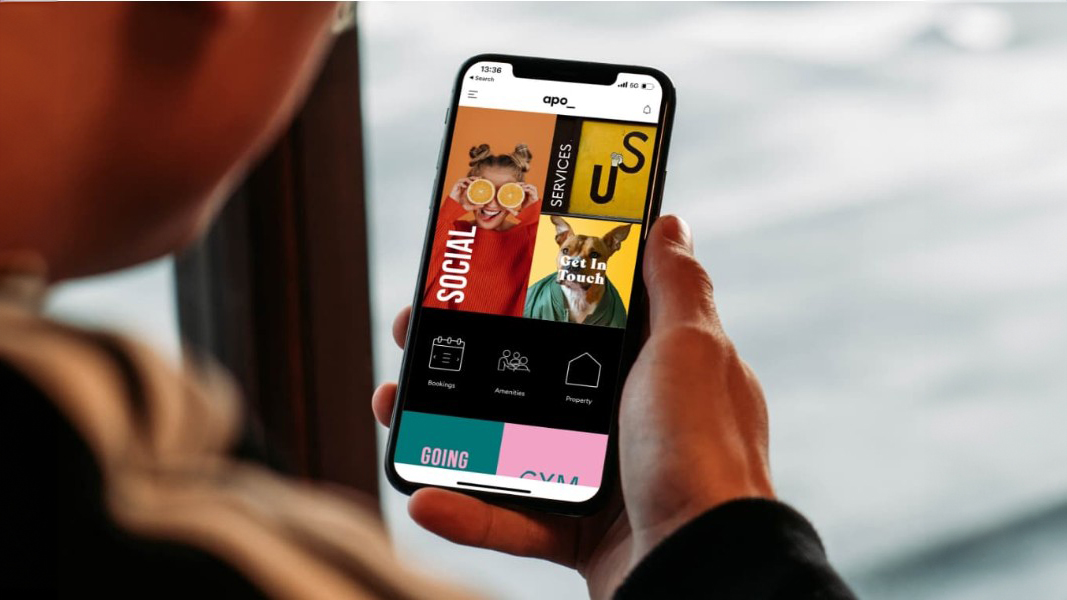

Andrea says many of these developments employ “resident hosts”, who are the day-to-day contact for tenants and who also help to create communities, host events, and encourage neighbourly connections. Residents can chose how much or how little they want to engage. Dedicated residents’ apps enable them to manage home and lifestyle needs—from chatting with resident hosts, reporting issues, and booking cleaning or handyman services to reserving spaces or signing up for events. Residents themselves organise other activities such as dance groups or running clubs, which offer great ways for people to connect—if they want to, Andrea says.

Living with Ease and Innovation.

It’s all about trying to reconnect people and create communities, and it’s very rewarding to go into an established development and experience the buzz and hype and social connections.

“We have even added drycleaning lockers (lockers where tenants can leave their clothes for the local drycleaner to collect and return), and vending machines for the rental of tools, irons, ironing boards, play stations etc – things you might only want occasionally for a few hours, a bit like a toy library,” says Andrea. “All of these extras aim to enhance the tenants’ convenience and ease of living.

“The idea behind these innovations is to ensure your home offers convenience and simplicity, where everything you need is at your fingertips.”

Security for Tenants and Investors.

For institutional investors such as pension funds, who often bankroll and own these developments, the model provides predictable rental income, stable cashflows, and long-term capital gains. Professional management companies operate the complexes on behalf of the investors, so funders don’t need to get involved in maintenance or tenant issues. Andrea says this model works well for both tenants and investors.

Because investors cover the maintenance costs, they want the apartments built to a high standard with quality fit-outs to minimise ongoing expenses. As a result, tenants enjoy a better-quality product. Tenants can sign long leases, but generous break clauses offer easy exits—after, say, six months—if their circumstances change. This long-term ownership model gives renters the security of knowing their flat won’t be sold out from under them due to an owner’s change of heart or need for cash.

And because build-to-rent companies often develop and manage similar projects across the UK, tenants can move between developments or into larger or smaller apartments within the same block. For example, if they have children and need more space or relocate to another city, they can find a suitable option.

Keystone Trust: Empowering the Next Generation of Property Leaders.

Keystone Trust launched in 1994 to support students entering careers across the property and construction industries. In 1995, the Trust selected Andrea Salter from Northland as one of its two inaugural scholarship recipients.

Today, the Trust supports students nationwide as they pursue tertiary qualifications in the built environment, helping to create a diverse and skilled pipeline of future industry professionals.

Over the past 31 years, Keystone has awarded 338 scholarships and distributed $2.95 million in funding, thanks to the generous support of its sponsor network. Vincent Capital is proud to be a key sponsor of the Trust, alongside a collective of leading New Zealand property businesses that are committed to helping young people succeed—particularly those facing financial hardship or difficult life circumstances.

“With strong support—at both student and alumni level—these talented young people are given the tools to thrive and go on to lead the property and construction industries into the future.”

– Amanda Stanes, General Manager, Keystone Trust

This vital work continues to ensure that students with potential but limited means can access the education, networks, and mentorship they need to build lasting careers in the built environment.